JP Morgan(JP Morgan) warns that artificial intelligence (Aye) Copper shortage may increase at the end of the decade due to increased demand.

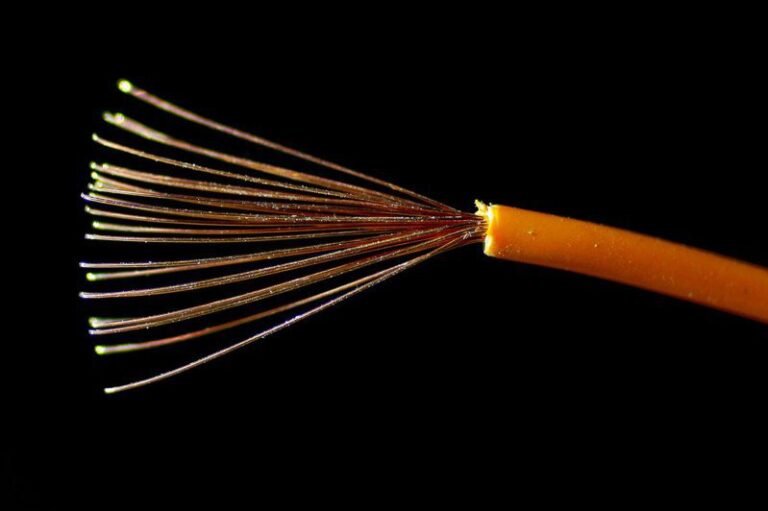

Because copper conducts electricity, is used in wiring, and is relatively low cost, it is an important part of power infrastructure upgrades. As AI servers increase power consumption, data centers will have to modify their power and cooling systems.

Dominic O’Kane, an analyst at JPMorgan, wrote on Thursday that the increase in demand brought about by AI “will further narrow the already huge copper supply gap in the second half of this decade. This will have great implications for the future of copper.” “It will have a big impact.” demand.”

Based on the International Energy Agency (IEA)’s baseline assumption of a 15% annual increase in data center electricity demand, O’Kane predicts AI will add an additional 2.6 million tonnes to total copper demand by 2030. Even without electricity demand from AI, JPMorgan predicts a cumulative supply shortfall of 4 million tonnes by 2030.

O’Kane wrote in the report: “The analysis suggests that demand for copper in data centers could be another strong support for long-term structural demand growth for copper. We believe that data centers, cryptocurrency “And the popularity of AI/machine learning could lead to higher power consumption, and increased demand for equipment like transformers.”

For AI workloads,Huida(Nvidia) once said that two GPU servers can handle the work of 1,000 CPU servers at a fraction of the cost and energy consumption of the latter. Still, improvements in GPU performance will increase overall power usage as developers look for new ways to leverage AI.

O’Kane’s three favorite global copper stocks are Anglo American, Teck Resources and Sandfire. He rates all three companies as “overweight.” But O’Kane isn’t all bullish on copper stocks. He has an “underweight” rating on Southern Copper and a “neutral” rating on Freeport.

Finance(TagstoTranslate)AI(T)JP Morgan(T)HUIDA